The Anatomy of a Bubble

Anyone who wasn't living under a rock in December knew what was going on with Bitcoin and its ilk. With rallying cries of 'to the moon!' and massive amounts of media attention, the euphoria and wide-eyed adulation of cryptocurrencies seemed to be a panacea for any financial problem. It'll change the world, they said. This is the future, they said.

Then came the crash, and reality. For many who are new to following markets, this was Baby's First Speculative Bubble. Skeptics called it a bubble beforehand, while many were dazzled by record returns.

Some 'experts' have still not given up the ghost, and expect Bitcoin and other cryptocurrencies to make a major rally. But if history is any indication, they won't--because Bitcoin has been directly tracking the pattern of a classic bubble.

Consider the following chart, that describes the stages of a bubble:

Image credit: https://transportgeography.org

Compare that to the current Bitcoin chart, and it's like a palsied first-grader drew it with tracing paper:

Image credit: Coindesk

Now, clearly the whole story isn't over yet--cryptocurrencies will likely find a value floor, as they'll always have both stalwart supporters and hapless investors stuck in the sunk cost fallacy. Blockchain technology itself holds a great deal of potential for the future, especially for those who aren't too keen on the current system of central banking. And while we're on that topic, those who say that cryptocurrencies hold no intrinsic value are right--as are those who point out that, well, fiat currencies like the dollar or the pound or the euro or the yen or the renminbi don't hold any intrinsic value either.

The point of this post is certainly not to denigrate Bitcoin or others like it, nor is it to point the finger at anyone. Bubbles happen. and as long as human nature remains human nature and people have money, bubbles will continue to happen. This is just the most recent example.

Like most bubbles, Bitcoin represents a frenzy of optimism far in excess of any real value provided by the product. There are numerous examples in history, and in case you've ever felt dumb for being caught up in one recall that even geniuses like Isaac Newton have been burned in bubbles. When the frenzy really gets going good, people start to take massive leveraged positions, exposing themselves to risk. When there's a downturn, they'll need to sell and deleverage in order to retreat and lick their wounds.

The main appeal of a bubble, and its proximate cause, is the desire to get rich quickly. That desire, by itself, is certainly nothing unusual. However, getting rich from a bubble has a special bonus: you get to tell yourself and everyone else that you're really, really smart if you actually do manage it. It's a feather in your cap. It inflates both your pocketbook and your ego. Win-win!

Except that the smart money is usually in early, and by the time most people hear of it or think about investing, it's too late. Anecdotally, I heard many times more recommendations to buy Bitcoin, or Ethereum, or Litecoin in December than I had in the several years preceding combined. That's the problem with bandwagons--they're crowded.

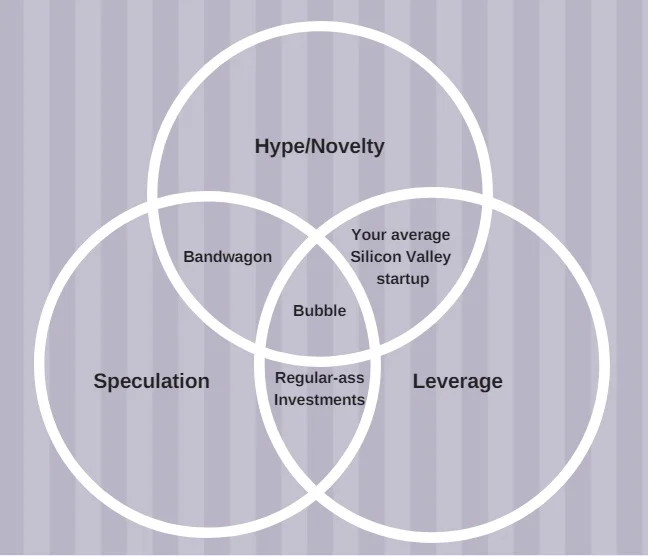

In looking at this situation, and others like it, I've noticed three necessary trends to make a bubble. Of course, this is an imperfect science, so feel free to chime in if you have any input. I've made this handy-dandy diagram to help you visualize it.

Image credit: me

First, you need to have a product or an idea that's new. People's imaginations need to run wild, outside the constraints of trial and error. Remember the dot-com bubble in 1999? People were predicting the absolute and overnight transformation of society. Meanwhile, it took 5 minutes to load a shitty Geocities page.

Second, you need speculation. Moneyed peoples need to believe that there will be significant return on their investment--and ideally, quickly. This ties to the hype: when you hear other people talking about your pet investment, you can all get together and enjoy a good old-fashioned circlejerk while driving the prices ever higher.

Third, and this part seems necessary: you need leverage in order to inflate a bubble. In other words, people need to be playing with other people's money in order to take the risks necessary that lead to the bubble. Whether it comes from personal conviction or simply a gambling and entrepreneurial spirit, people will gladly double down on their bets when their hands are full of money they didn't have to work for. Yet.

Food for thought: numerous stock indices are looking bubblish in the US. The fundamentals laid about above are there: investment banks have plenty of other people's money, and speculation is their job. And although stock markets aren't new, they'll always find new poster boys. Meanwhile, lots of historically safe bets aren't worth it. What else is a poor trader to do?

That's all, for now. I plan on using this framework to look at a local phenomenon next, to try to decide whether it's a speculative bubble or not.